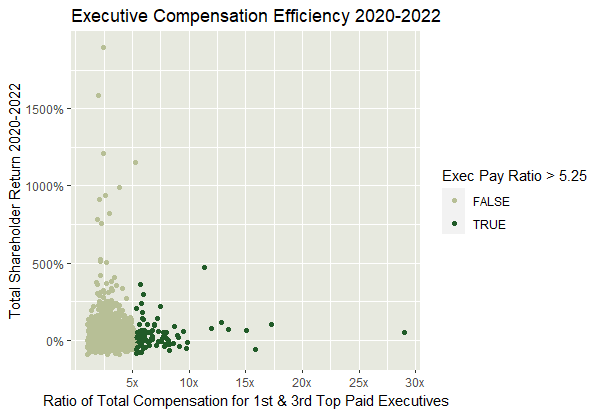

When we conducted a three year (2019 – 2022) pay and performance comparison of the top ~2,000 public companies (by market cap), we found CEO pay that was too far removed from the other named executive officers (NEOs) resulted in an inefficient relationship between the amount of compensation delivered and shareholder return generated. Specifically, companies that paid the CEO more than 5.25 times the compensation paid to the #3 NEO ended up paying 27% more than similarly-sized companies but produced below average shareholder returns.

See below chart for more detail:

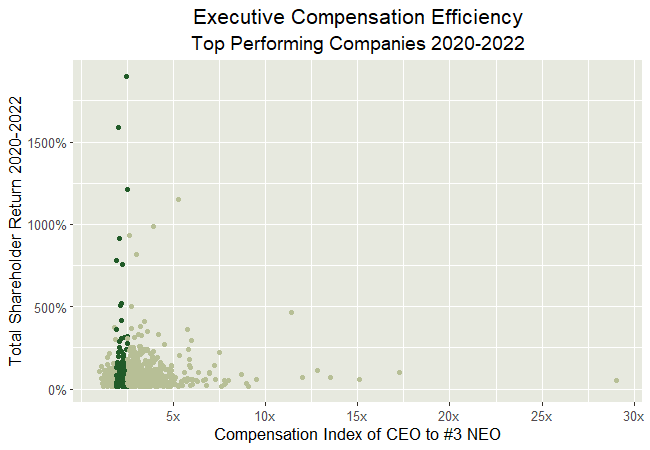

Further, the team found that the data indicated there was an optimal ratio of pay between CEO and #3 NEO of 2.0x – 3.0x, whereby companies paid approximately the same amount as other similarly-sized companies to produce ~25% better shareholder returns on average.

- Analysis provided by: Ian Keas, Zayla Partners; Ben Quint, Zayla Partners; Jared Brown, Texas A&M