2023 E&P Bonuses – Strong Payments Ahead

As the end of August nears, companies are wrapping up Q2 FY 2022 earnings reporting, summer breaks are winding down, and company leaders are turning their collective attention to what needs to be done to close out FY2022 and prepare for FY2023.

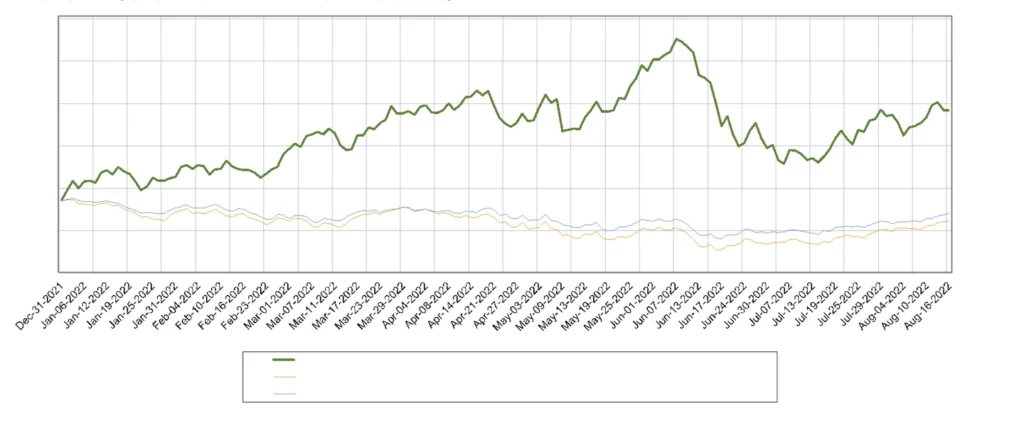

2022 has been an eventful year for all market participants thanks to the many variables currently at play – inflation, labor market trends, volatility in high-growth segments, new tax legislation just to name a few – and especially so for the U.S. oil and gas exploration and production (E&P) industry which has generated stock price outperformance of 52 basis points relative to the S&P 5001; a level it has not seen in years (see chart below).

Given recent evolutions on E&P pay and governance, as well as ongoing critical rhetoric in the political sphere, Zayla anticipates there will be much discussion of bonus payouts for executives when the 2023 proxy season rolls around. We believe a quick overview on FY 2021 data and real-time understanding of current practices will be informative on potential outcomes for FY2022 bonuses payable in Q1 2023.

FY 2021 Bonus Plans – Design

In the previous “heyday” window for the U.S. oil and gas industry, bonus plans were largely designed to encourage operational growth. At that time, the common business model in the industry was to quickly ramp up production and get reserves on the books, given the view that doing so would generate the greatest value for shareholders.

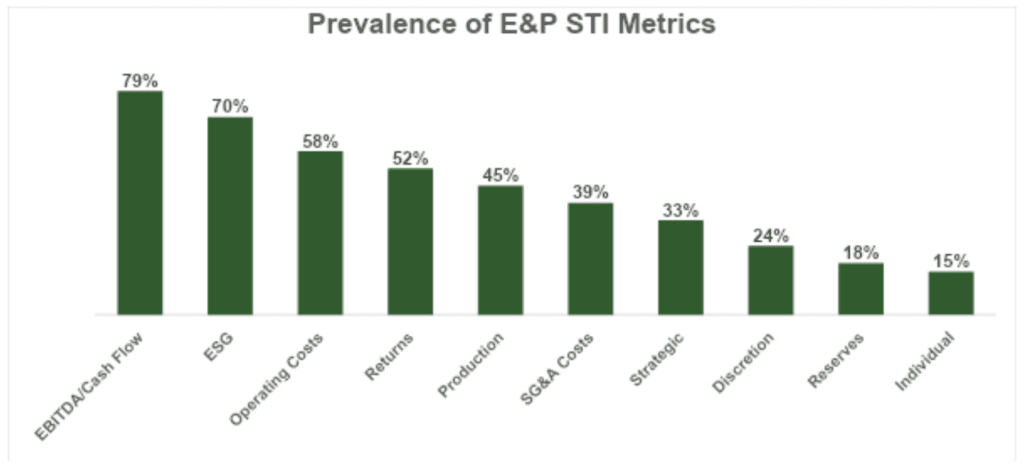

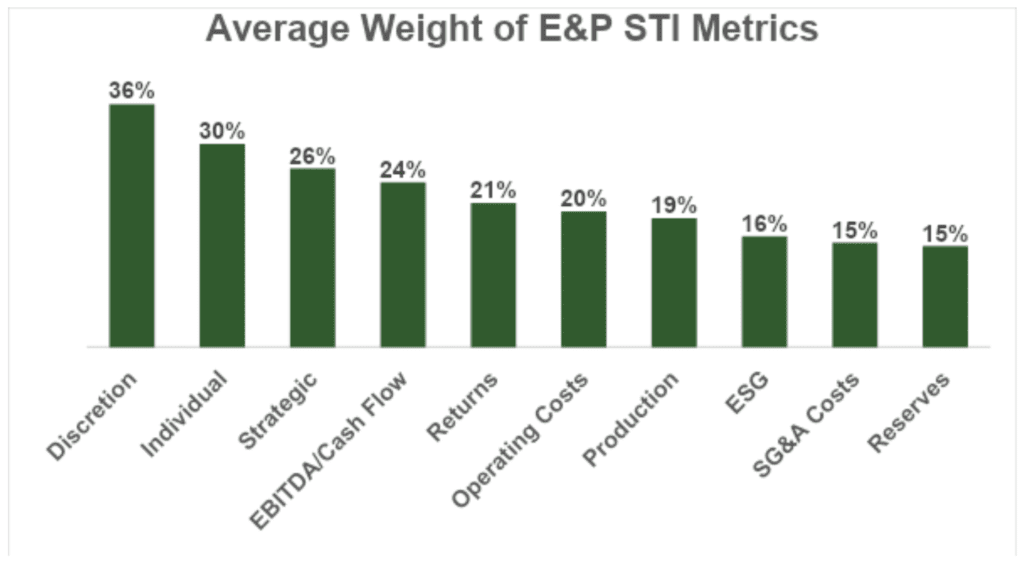

Supporting such models were annual bonus programs that were largely dedicated to production and reserves growth goals. That dynamic is a stark contrast to today’s marketplace, where evolutions of investor influences on executive compensation and governance have led to annual bonus plan models that prioritize metrics focused on cash returns to shareholders, Environmental, Social, Governance (ESG), and capital and operating efficiencies.

These observations are supported by a recent analysis conducted by Zayla. The chart below illustrates short-term incentive metric prevalence across 33 U.S. E&P companies in 2021, which illustrate the industry’s renewed focus on metrics tied to shareholder interests and views. Some other interesting observations Zayla noted in the data included the following:

Production Metrics

While much of the discussion on E&P compensation in the public domain has focused on cash return to shareholder measures, production continues to be a common metric in annual bonus plans. Given recent inflation pressures, global political instability, and critical commentary from certain groups on the availability of fossil fuels, production/supply of fossil fuels may see greater spotlight in future years resulting in renewed focus on production-related performance metrics.

Environmental, Social & Governance

ESG has risen significantly in conversation and incentive metrics over the last 5 years. While it is the #2 most prevalent metric, the weight of it is generally about 15% of overall short-term incentive opportunity.

Plan Design Intricacies

Complexity is on the rise in plan designs. In our experience, formulaic bonus models have a limit on effectiveness, as over-complexity (increased number of measures and increased complexity of measures) can limit the impact incentives have on executive performance and decision-making.

Environmental & Emissions-Focused Design

Real-time insights on incentive designs for FY 2022 suggest slight adjustments this year on designs relative to FY 2021 practices. The main changes have been focused on lowering the discretionary weight and refining ESG metrics, with boards, investors, and management addressing their companies progress on reducing carbon emissions. Characterized well by one recent client interaction: “evolution as opposed to revolution.”

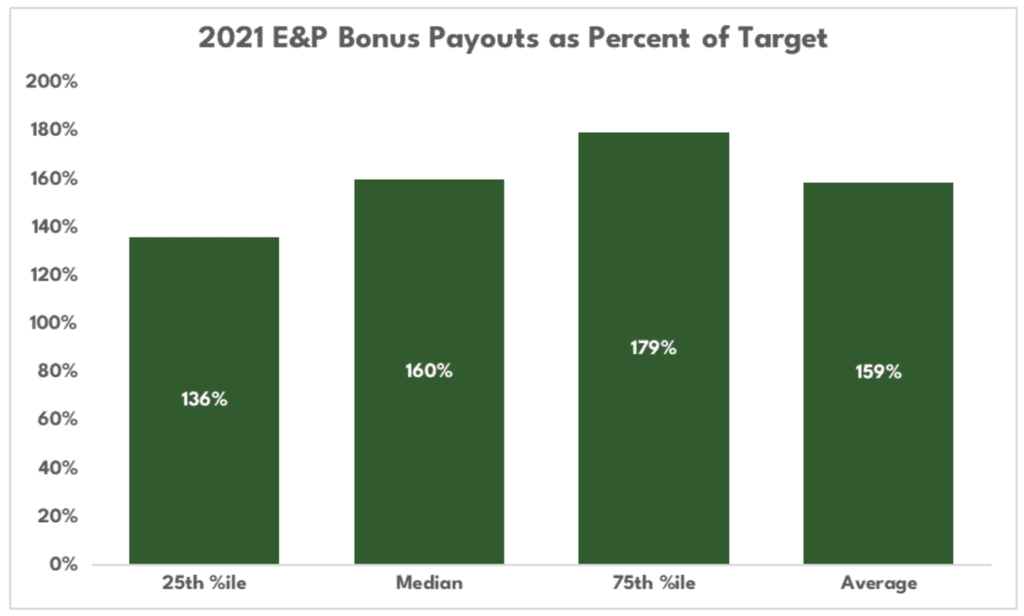

FY 2021 Bonus Plans – Payouts

Using the performance of the XOP index over FY 2021 as a barometer, the E&P industry generated strong performance from a valuation standpoint over the course of the year (62.4% growth). It should be no surprise that bonuses were similarly “strong” relative to target opportunities. Zayla’s recent analysis found payouts across the industry averaged nearly 160% of target, well above target for the year – see the graphic below for more detail.

FY 2022 Bonus Plans – Payout Projections

While E&P performance YTD has been exceptional, and commodity prices have been well above forecasts for the year, there is still a quarter to go. And as the veterans know, three months in the energy business might as well be a lifetime of volatility.

That said, based on Zayla’s observations on E&P bonus designs for FY2022 and early reads on performance for the year to date, we estimate 2022, payable in Q1 2023 are going to look much like those from FY 2021 paid in Q1 2022. Given the industry’s returns and share price outperformance relative to the broader market, this should be a welcomed outcome for the strong performers.

Source(s):