Thanks to the combined effects of trade wars and the rapid expansion of artificial intelligence technologies, market interest in rare earth mineral and mining companies has hit a crescendo over the last few years. From AI resource demand, tariff effects on supply chains, to government investments, the attention given to these companies has been warranted.

The increased demand, investment, and visibility surrounding these strategic rare earth assets have fueled competition for experienced executive leadership, creating notable ripple effects across rare earth executive compensation levels. Zayla, a Gallagher Company, a leading rare earth and mining compensation consulting firm, recently completed a six-year analysis of CEO pay trends from 30 publicly listed companies across US and Canadian exchanges. From this analysis, Zayla noted three major observations.

Observation 1: CEO Compensation has increased 66% over three years

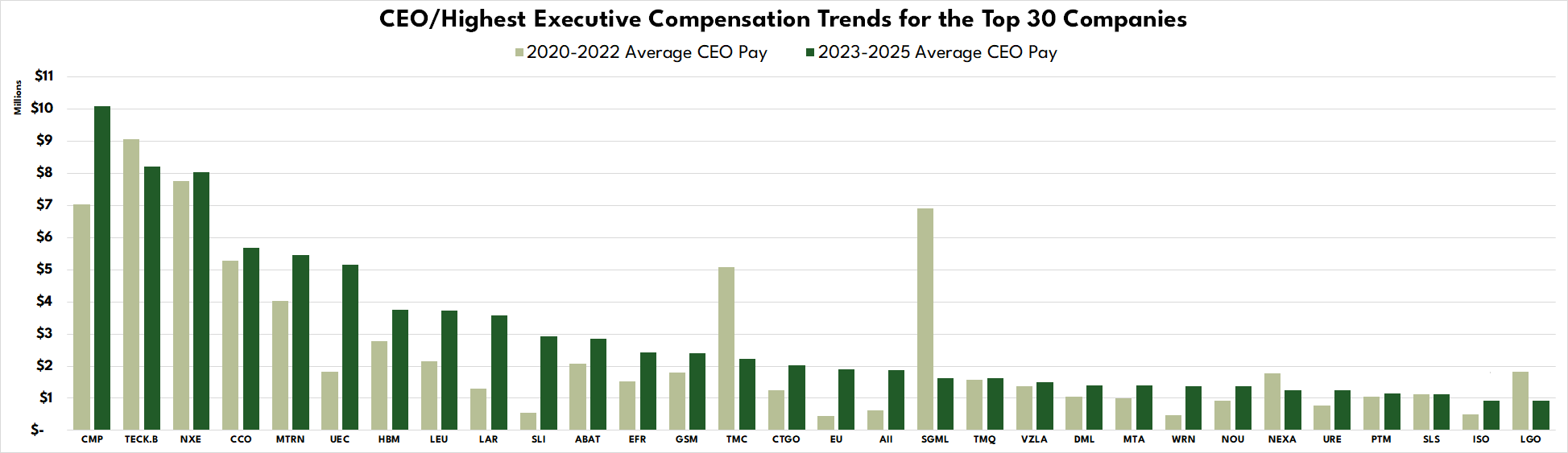

Zayla analyzed average rare earth CEO compensation over two successive 3-year periods, using data from the 2020-2022 and 2023-2025 proxy seasons. Note that 3-year periods were used to mitigate some of the volatility in data from year to year.

When comparing findings from each period, Zayla noted CEO total direct compensation increased on average 66%. That equates to an annual increase of 18%, significantly higher than the Russell 3,000 annual increase of 9.7%. This significant increase in compensation is reflective of the demand for talent in the rare earth industry, coupled with a tightened labor market for senior leadership capable talent across the US and Canada.

The pay growth also highlights the importance of market-based executive compensation benchmarking and performance-aligned incentive design in the mining industry.

We note the increase in compensation is not just labor market-driven, as increases in valuations and improving shareholder returns have driven boards to reward leadership through pay-for-performance compensation structures and equity-based incentive plans. If one can see the forest from the trees with these confluent influences, it’s easy to understand why the significant uptick in executive compensation.

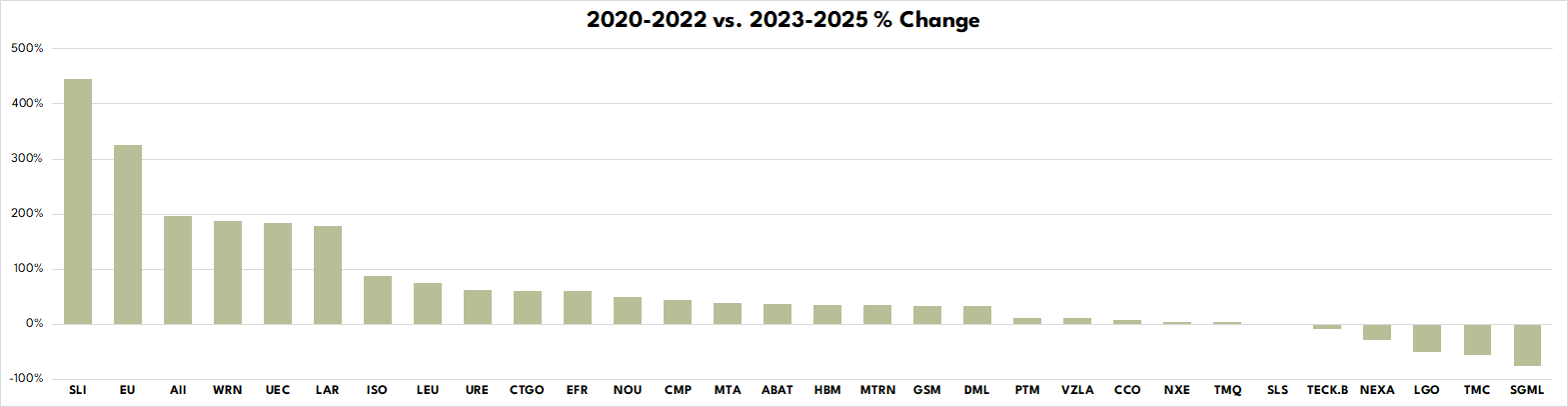

Observation 2: CEO Compensation has been volatile

The average annual volatility, calculated as the annual percentage iincrease or decrease, in CEO compensation for these 30 rare earth companies for the prior 6 years was 70%. Additionally, the spread of year of year change in compensation ranged as high as 133% positive to 14% negative. This level of variability underscores the need for proactive executive compensation analysis & design and risk assessment support.

We can all agree the macro stock market has been anything but “mainstream” the past 6 years. Layer on the financial volatility of rare earth companies and more recent increased demand and investment in the sector and it’s not a surprise to see such wide ranging changes to executive compensation.

Observation 3: 57% CEO turnover in 6 years

Executive turnover has added to the significant increase and volatility of CEO compensation for rare earth companies over the past 6 years. Across the dataset of 30 companies Zayla analyzed, 50% had a change in CEO during one of the 3 year blocks. This level of succession at the CEO position aligns with a broader changing of the guard Zayla is observing across the executive talent market, as baby boomer aged executives retire and get replaced by the next generation. Leadership succession planning and transition compensation advisory services are increasingly relevant in this environment.

In what is looking to be a perfect storm, rare earth companies are attracting new investors, new money, and are actively seeking high growth executive teams for the future. As rare earth companies look for strong executive leadership to grow into the next phase, they will bring about further increases to executive compensation.

Zayla, a Gallagher Company, is a leading compensation advisory firm serving rare earth and mining companies with executive compensation consulting, governance advisory, incentive plan design, and benchmarking services. For questions related to this analysis or executive compensation strategy and governance support, please contact the Zayla team.