Zayla recently completed an expansion of its previous analysis highlighting CEO pay trends in the energy industry based off data from the 2025 proxy season.

Company Universe

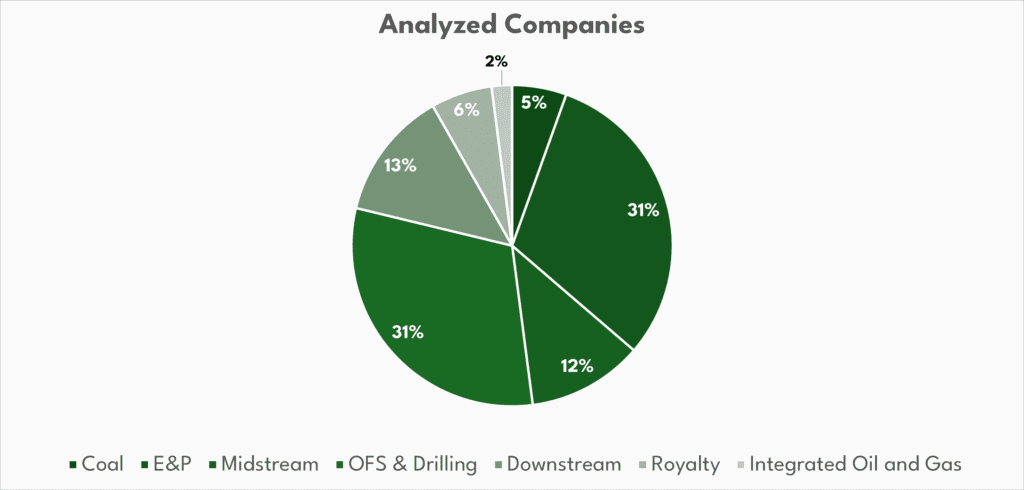

Zayla analyzed compensation data from 183 companies that filed either a DEF14A or a 10-K filing as of June 4th, 2025.

Forty three companies were omitted from the analysis due to not paying their CEO in the last fiscal year or not having a compensated principal executive.

The analysis covered all energy industry segments, split as follows:

The revenues in FY2024 of less than $1B came out to almost 48%; the remainder ranged from $1.1B – $339.2B.

The median revenue was $1.159B, representing an increase of 2% over the prior year.

Energy CEO Compensation Trends

Zayla noted the following trends in CEO pay from the 2024 fiscal year:

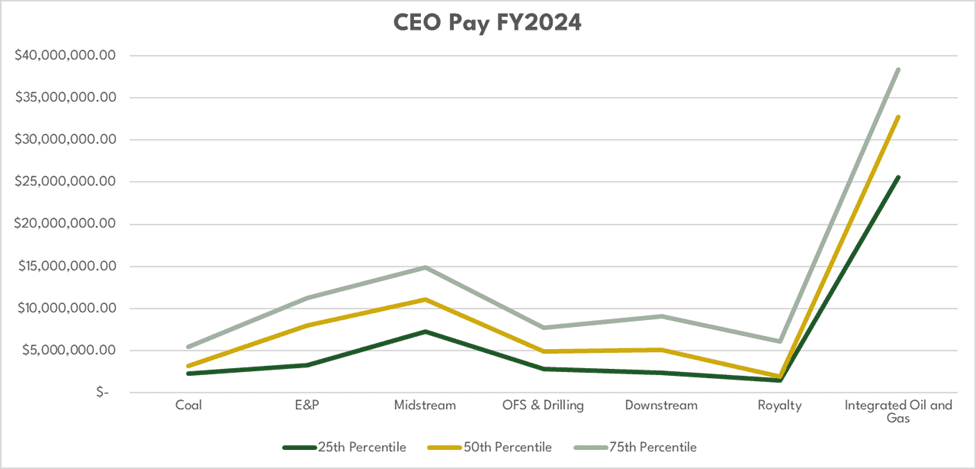

- CEO pay across all companies ranged from $2.9M at the 25th percentile up to $10.4M at the 75th percentile – reflecting a median increase of 8% over FY2023.

- As expected given its size and complexity of operations, the Integrated Oil and Gas segment reported the highest median compensation (and corresponding highest revenue), while Coal & Consumable Fuels companies reported the lowest.

- E&P companies reported the largest spread in CEO pay, highlighting the variance of pay practices within the segment.

- On a revenue-adjusted basis, Zayla noted that energy companies to date reported that companies spent 0.41% of total revenue on CEO compensation (at the median); and

- Continuing a trend noted in FY 2023, incentive pay outcomes reported in 2024 were strong relative to target:

- Most energy companies utilize formulaic approaches to determining short-term incentive compensation for their executives. For FY2025, Zayla noted that CEOs received payouts of target or better, with a median payout of 118% of target.

- Continuing the trend of limited use of discretion in executive pay programs, Zayla noted only 9 companies disclosed discretionary adjustments to bonus outcomes for 2024 – of which the majority applied negative discretion.

- Given the timing and magnitude of market volatility so far in 2025, Zayla notes there may be an increased use of discretion on 2025 incentive outcomes, especially if quantitative performance results are near threshold or lower.

- Companies that had performance-vesting long-term incentive awards vesting during FY 2024 reported outcomes generally well above target, with a median payout of 135% of target.

- Most energy companies utilize formulaic approaches to determining short-term incentive compensation for their executives. For FY2025, Zayla noted that CEOs received payouts of target or better, with a median payout of 118% of target.

All in, Zayla observed 8% increase in reported CEO pay for energy companies relative to FY2023, which has been supported by shareholders this say on pay season given it corresponded with positive total shareholder return over the year.

Concluding Thoughts

Zayla notes the above observations mirror the firm’s experiences advising compensation committees and management teams across the industry as well as trends noted in ECI survey data. Despite pressures from consolidation and commodity volatility, the industry continues to see a tight labor market resulting in continued growth in compensation investments to attract and retain top talent. 2025 has brought considerable volatility to the industry (average stock price performance for these companies of -11% since “Liberation Day”), so it will be important for companies to keep a clear understanding of what competitors are doing from a compensation perspective to ensure their offerings are calibrated as needed going forward.

For any additional questions on this analysis, or energy industry compensation questions generally, please contact the team at info@zayla.com or (832) 363 – 5089.