At Zayla, we believe variable pay programs are essential tools for aligning a portion of employee compensation with organizational and individual performance. When thoughtfully structured, they help to motivate employees, drive business results, and retain top talent by linking pay to near-term performance outcomes.

This is why understanding the key components and market best practices of these programs is critical for organizations seeking to maximize the impact of their compensation strategy.

Understanding the Common Types of Annual Incentives

Incentive plans typically supplement fixed compensation (i.e., base salary) with performance-based pay that fluctuates based on measurable achievements. This pay-for-performance model is especially common at the executive level, and similar plans can be designed for key staff in other levels or functions of an organization. The core purpose of these pay programs is to motivate employees by providing financial rewards directly tied to their contributions to company performance, encouraging alignment with company objectives and fostering a results-driven culture. Three of the most common forms of annual incentive plans are as follows:

- Short-term Incentive Plans (STIPs). Lump-sum cash bonuses tied to quantitative and/or qualitative performance measures. These are often paid on an annual basis, but we note that some companies may opt to design payouts that occur on a different schedule (e.g. quarterly). The majority of executive level employees, middle management and professional staff participate in these programs.

- Profit Sharing. Incentives where companies distribute a portion of their profits to employees, typically based on a company’s earnings and an individual’s These programs aim to align employees’ interests with the company’s success, encouraging higher productivity and engagement. Profit sharing can take various forms, such as cash payments or contributions to retirement plan accounts.

- Sales Commissions. Payments based on a percentage of sales revenue generated, rewarding ongoing sales performance. Sales commission is typically reserved for sales and business development staff only. Rarely do we see upper management or non-sales staff participating in this kind of program.

It is important to note that incentive structures (outside of 100% commission structures) are always balanced by a base salary component of the compensation structure to ensure an employee’s financial stability, which allows the variable portion (often called “at-risk” pay) to be 100% performance driven. If performance targets are not met, this at-risk portion may be reduced or eliminated. Inversely, bonus plans should also provide upside earnings potential, allowing participants to earn “above target” compensation if outperformance is achieved.

Short-Term Incentive Plan Design

Traditional annual cash bonus programs are the most common form of short-term variable pay. They serve as effective plans that reward employees for achieving predefined goals within a given fiscal year. These programs reinforce company priorities and support the execution of strategic annual objectives that lead to longer-term value creation. Zayla notes that in order to maximize the effectiveness of a short-term incentive plan, organizations need to consider the following guiding principles:

- Ensure the plan is aligned with broader company “key performance indicators” (KPIs) and shareholder interests.

- Design the plan to support both short-term execution and long-term value creation.

- Align incentives with outcomes employees can impact (line of sight).

- Use transparent, fair, and measurable performance metrics (typically 4-6 metrics).

- Establish performance hurdles with appropriate rigor (probability of achievement).

- Ensure bonus target opportunities are market competitive (motivating).

- Review and refine plans to adapt to changing company and market conditions (at least annually).

Below are key steps and components to consider when designing a short-term incentive plan:

- Select Relevant Performance Metrics. Effective bonus plans rely on selecting specific, measurable, and relevant performance metrics, such as:

- Financial metrics: Revenue, EBITDA, net income.

- Operational metrics: Productivity, quality scores, customer satisfaction, strategic plan execution.

- Individual metrics: Individual goals and objectives, individual performance reviews or discretionary/subjective evaluations.

- Adopting a balanced scorecard approach that combines financial and non-financial metrics encourages a comprehensive evaluation of performance and optimal pay and performance alignment.

- Set Meaningful Goals. One of the most difficult aspects of designing short-term incentives is determining the right performance hurdles. In Zayla’s experience, performance hurdles should be:

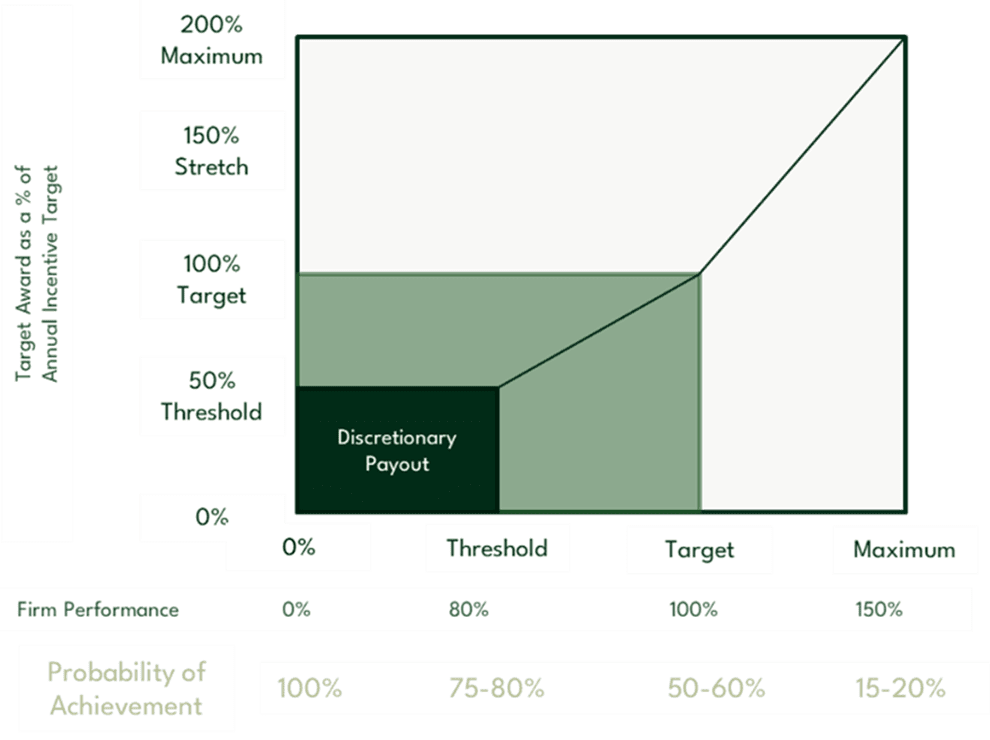

- Rigorous yet attainable – consider probability of achievement when setting performance hurdles for threshold, target and maximum opportunities as illustrated in the graphic below).

-

- Set based on historical data, market benchmarks, and company strategy.

- Clearly communicated and periodically reviewed to stay relevant amid changing business conditions.

- Aligning Short- and Long-term Objectives. While STI plans are inherently short-term, they should reinforce progress toward long-term business goals and value creation. For example, rewarding near-term profitability should not come at the expense of long-term sustainability. One way to bridge this is by including metrics that measure forward-looking initiatives alongside short-term financial results.

- Establishing Competitive Award Values. Determining how much to award should be based on job level, market competitiveness, internal equity and company financial sustainability. Typically, target bonus opportunities are set as a percentage of base salary, increasing with job level and overall responsibility. Companies should clearly define payout ranges based on performance parameters. For example:

- 50% of target payout for threshold performance

- 100% of target payout for target performance

- 200% of target payout for maximum performance.

Benefits and Challenges of Annual Incentive Plans

There are clear advantages of implementing a variable pay program:

- Performance-Driven Culture: By linking pay to performance outcomes, these plans drive productivity and focus on company goals.

- Motivation and Recognition: Direct financial rewards boost morale and job satisfaction.

- Retention of High Performers: Top talent remains motivated when rewarded fairly for their contributions.

- Flexibility: Plans can be adjusted to reflect market changes and evolving business priorities.

Potential drawbacks associated with variable incentive plans:

- Unhealthy Competition: Overemphasis on individual targets may reduce collaboration.

- Complexity: Designing balanced plans that are fair and understandable can be challenging.

- Risk of Underpayment: Poorly calibrated goals may frustrate employees if rewards seem unattainable.

- Disengagement: If incentives feel out of reach, motivation can significantly decline creating potential flight risks.

Thinking Around the Corner – Handling Termination of Employment

When employees are terminated or voluntarily depart a company mid-cycle, companies should have clear, consistent policies in place regarding the impact of such separations on bonus payouts to ensure fairness and the avoidance of legal disputes. For example, these policies should specify whether bonuses are pro-rated (based on time worked), whether payments should be made on actual performance or target bases, and whether the employee must be actively employed on the payout date to qualify.

For resignations, companies may choose to award bonuses if the employee departs as a “good leaver”. In cases of termination, the nature of the termination—with or without cause—should influence eligibility. Transparent communication of these rules in employment contracts or bonus plans is essential, and any exceptions should be documented and approved by management or HR.

Final Thoughts

Variable pay, when carefully designed and managed, is a powerful driver for employee performance and business success. It helps create a motivated, engaged workforce aligned with organizational goals, fostering a culture of achievement and continuous improvement. Employers must thoughtfully tailor these plans to their unique contexts and communicate expectations clearly to deliver fairness, motivation, and sustained value and an independent compensation consultant can help companies make incentive plan design seem effortless.

At Zayla, incentive plan design—both short-term and long-term—is our niche within a niche. We believe variable pay is the most vital component of a well-rounded compensation strategy, especially at the executive level. In today’s dynamic business environment, thoughtfully executed incentive plans can address some of the most complex and persistent challenges organizations face.

Connect with us today to explore how we can help you build meaningful and market competitive incentive plans that drive performance and deliver lasting value.

If your organization would like to partner with us, contact the team at info@zayla.com or (832) 363 – 5089.